Yesterday, I went into some of the background about how and why I and my fellow attorneys put up with sitting through (and, this year in my case, writing and presenting) dull-as-dishwater presentations on legal topics to keep our licenses. It also set the virtual stage for the two afternoons I chose, last year and this, to satisfy roughly half of my obligation in this regard. The chosen platform for this program was Zoom, which at least I've been using for over two years. It is less buggy than its Microsoft cousin, and the links don't go byebye into my Outlook calendar like the Teams ones do.

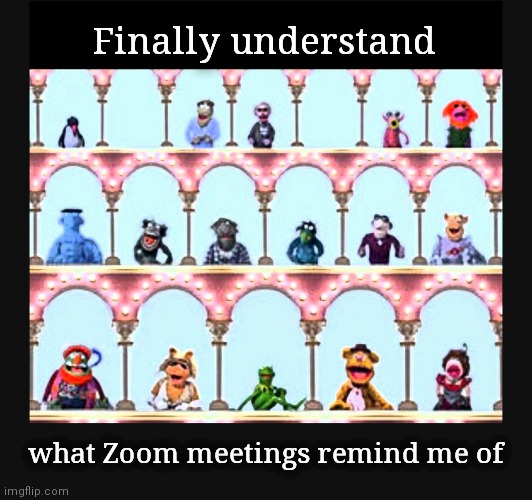

Except.... Zoom Webinars are not the Zooms I do Bar Association committee and writing and poetry groups in. The login and waiting/entry are the same, but you don't get the display you're used to-

Once you are "let in" at a webinar, you only see the speakers, and they can't see or hear you. You, mere peon participant, are limited to the typed-in chat and Q&A features, which are only seen by and only identify you to the speakers, the latter only if you don't send the question anonymously. You also get no clue whatsoever about who else is a fellow attendee of the program.

Until, that is, you are one of the speakers, as I was on the first day of this thing. Then the host magically "promotes" you, and you'd better not be drooling when the camera suddenly pops on. You can now see the other speakers, and they, you; but you still cannot see Kermie or Fozzie or anyone else in the room. I discovered, an hour into my magical powers, that you can pull up a list of the participants actively on the program at any given moment. That helps when you want to acknowledge a participant whose schtick you are plagiarizing ("Hi, Lou!"), because you'll want to know if Lou is there or not. (If it's Jeffrey Toobin, maybe not so much;)

You also have to be ready at all times to take down those alphanumeric codes I mentioned yesterday. You get a form to fill these out on and then affirm, under penalty of perjury, that you didn't buy them off the internet. Yesterday's and today's each contained five spaces for the codes. So of course they rattled off six during the course of the five-plus hours. But then, we routinely deal with horrendous Congressional drafting, and at least twice on the first day, speakers told us about "hanging paragraphs" that contain important provisions in a paragraph not numbered after five paragraphs numbered, say, 1-2-3-4-5. I don't know; maybe Jesse Helms was afraid people would realize it was the same numbers he had on his luggage. So I just shoved the mystery sixth code at the bottom of the first day's form, and will do did the same for the second, because they've assured us it will happen again.

----

You read this far, so it would be even meaner of me to go over my own materials on valuation or anything other than the one section I mentioned we would get to today: the strange cases of Tingling and N.M., both cited by a regular lawyer for a student loan creditor, who seemed awfully pleased with himself that the borrowers of these obligations were, and would likely continue to be in technical terms, FUCKED.

Here's 40 years of tortured history in a paragraph. Every bankruptcy seminar schoolboy/girl/them knows that you can't get rid of student loans in bankruptcy. Yet that's not exactly what Congress said when they rewrote the whole law in 1978: they would survive unless a debtor proved "undue hardship;" unless they filed a repayment form of bankruptcy (Chapter 13) to pay some of them, discharging the rest; or unless they ran the clock out on the loans by holding off on filing for five (later seven) years after they first came due. Between 1978 and 1994, Congress took away both of those final two "unlesses," both on short notice to lawyers and made entirely retroactive. Outside bankruptcy law, Congress also slipped in a nasty provision that eliminated statutes of limitations for all applicable student loans, so there was no longer any running out of the clock, in or out of bankruptcy law. You were left with the first "unless," proving to a bankruptcy judge that paying the loan "would impose an undue hardship on the debtor and the debtor’s dependents." That seemed innocuous enough, until a guy named Brunner came along, early in the life of the Bankruptcy Code, and claimed undue hardship. The federal appellate court controlling New York and two other states said, Nopers, not that easy. You had to meet three prongs of proof, all three: hard, harder and hardest. RTFC if you care what they are. The Supremes never made it nationwide, but most other federal circuits adopted it, or an even worse standard of "certainty of hopelessness."

In the past few years, some sympathetic lower-court bankruptcy judges recognized that Brunner made much less sense now than it did in its original context. One, the other two "unlesses" were now gone. Two, the industry had changed over the years into a much bigger segment of the economy, much of it in equity and vulture funds, among those who got bailed out in various "too big to fail" efforts before and after 2008. Three, bankruptcy itself got much more limited and regulated in 2005. As a result, a "totality of the circumstances" test started to develop in some corners of our Second Circuit, which basically said to their appellate overlords, Hey, isn't it time to revisit this? One debtor who tried and failed to get a bankruptcy court to say that was named Janet Tingling, and in a March 2021 decision, a panel of the Second Circuit Court of Appeals said, Nopers, yall still fucked. Read that one, too, if you want, but I'll highlight these three sentences:

Tingling next argues that the Bankruptcy Court erred in its application of the so-called Brunner test in considering the dischargeability of her education debt. She further submits that the Brunner test has, over time, become too high a burden for debtors to satisfy. We do not agree.

They then go on to show why the lower court's application of the test was just fine, yep, no problem. Not one. Fucking. WORD about how the elimination of the other "unlesses" in the ensuing years, or the other economic and legal changes in that generation, should give these $223,700 a year appellate judges any reason to change a decision written when they, like me, had barely gotten their feet wet out of law school.

So our judges, including the one speaking on these panels today....

right. Thoughtus interruptus here. Why is only "the one" here? Dipped if I know.

Back to the bench and the guy on it who is here: our judges, including the one speaking on these panels today, continue to be bound by Brunner and it making it near impossible to get out of student loans. Today's speaker tried to reduce the prong of "minimal" standard of living to a "modest" one, and got reversed by his boss on that point in 2007 because Brunner, Brunner, Brunner. (Davis, Davis, Davis.)

Davis, in turn, also relied on an earlier and closer-to-my-home case, where a borrower tried to get out of their obligations. It was cited in Davis, and in yesterday's materials, only as In re N. M., (case case case). Among other things, N.M. argued that a mental condition was a severe impediment to being able to earn sufficient money with a law degree to achieve an ability to repay their loans. The judge sympathized, but not enough: Although this court understands how the burden of debt repayment may become a source of stress, the potential for such stress does not by itself satisfy the stringent prerequisites for the discharge of a student loan. In other words, Brunner Brunner Brunner.

When that decision first came out, the name was not redacted, and even now, any idiot with a computer search account can read one line of the decision with the redacted name and find what the name is. I don't need to. I knew who N.M. was when I saw the decision in 2005. N.M. was in my law school class. I wouldn't say we were friends, but we had plenty of them in common. N.M. was, and probably still is, a caring, bright and talented individual who deserved better from The System than they got. And it saddened me that N.M. is just a bunch of numbers and two initials being thrown around in a

The change will not come from the courts. That much is clear. Does it affect me? I paid back every nickel of my own edloans and was current to the penny on the bigger ones for Emily's education until COVID suspended the payments two years ago. They've almost restarted twice since, both times paused again by Joe until this fall- and some word came at Tuesday's session that they might be paused again, or reduced in some amount or percent or something in the future.

I don't care; I will pay what is due. I'm more concerned for the N.M.'s out there who do care and can't pay, who will take those loans to the grave (and in some cases- not ours- infect them on their heirs).

I've put in my continuing ed time now, possibly for the year. Let's get on to continuing caring.

Annnnd.... my 750 Words trial is up. Sorry, I'm not paying for you to tell me I talk too much about DEATH.